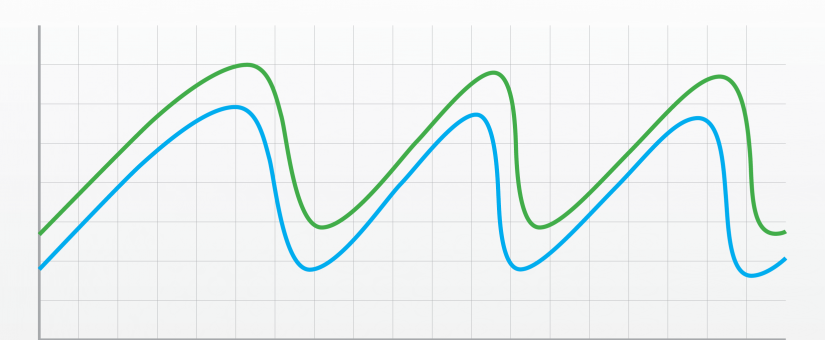

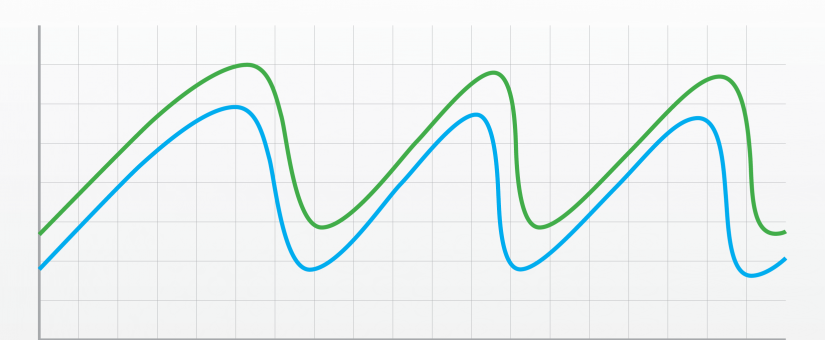

Together, these additional dimensions of visibility into cash flow give finance professionals deep, immediate insight into their domain. Cash flow speaks to what was purchased, procurement data speaks to why it was purchased, and how it was procured. In addition to supplementing cash flow data with this type of product, geography, organization, and function-level data, the new analytics platform enables finance professionals to deepen their understanding by overlaying procurement data onto cash flow data. For example, the cash flow analytics platform supplements typical cash flow data with the geographic region where a payment originated, the team responsible for the payment, and the segments-such as cloud or consumer products-that the payment belongs in. The cash flow analytics platform can answer questions like who paid an invoice, when the payment occurred, and what payment type was used.Įnriching existing data provides a more holistic understanding of payments. Cash flow statements typically answer questions like what did the department purchase. The end results add a dimension of understanding beyond the scope of the humble cash flow statement. The intelligence derived from the cash flow analytics platform is a result of both enriching existing data and combining that data in novel ways.

The technologies the Foundational Finance Services team used to achieve their visionĮlevating the role of finance professionals. The process by which the Foundational Finance Services team-part of the Microsoft Digital organization-built the platform. The motivation behind the move to the modern cash flow analytics platform. This paper examines the following topics: In this way, the cash flow analytics platform not only reports on historical data, but also plays a crucial role in optimizing and predicting the financial health of product segments, departments, and the entire Microsoft organization. Finance professionals can then transform those insights into actionable takeaways that directly impact business outcomes. The platform infuses cash flow analytics with deep intelligence, creating a tool from which Microsoft can extract unprecedented levels of granular insight into cash flow. It has also transformed the role of Microsoft's finance professionals.īuilding on the Microsoft Enterprise Data Strategy, which centralizes previously siloed data and makes it accessible via data lakes, the new cash flow analytics platform gives finance professionals the ability to dynamically interact with cash flow data. It can be a helpful solution to overcome cash flow gaps, quickly raise working capital, and get fast funding to cover operations and unexpected costs.Through a platform built primarily on Microsoft Azure, Microsoft has transformed the role of cash flow analytics within the company. Once payment has been received, we transfer the remaining balance of the invoice (usually 5%) to your bank account, less fees.Ĭashflow Finance releases capital tied up in unpaid invoices so that you can put tomorrow’s payments into your business today. When the invoice is due, ScotPac collects the amount owed on the invoice from the debtor. The funds are typically made available within 24 hours of the invoice being submitted. We transfer up to 95% of the invoice value upfront as a cash advance. At the same time, you submit the invoice to ScotPac for funding. You raise an invoice and send it to your customer after completing an order.

The funding process involves the following steps:

The most common type of Cashflow Finance is Invoice Finance.Īn Invoice Finance facility allows a business to use its outstanding invoices as collateral for funding. Cashflow Finance is a type of Business Finance that is based on expected cash flow.

0 kommentar(er)

0 kommentar(er)